ProDiscovery in Action

Finance

Achieving both user loyalty and work efficiency:

Towards excellence in banking industry

↑13%p

enhancement in re-deposit rate

↓90%

reduction in account opening lead time

4x

growth in new acquisitions

Why ProDiscovery for Finance?

Our use cases show that financial firms use ProDiscovery Process Mining for three main reasons.

- to simplify and automate employee tasks in order to comply with the government’s workhour regulations.

- to categorize the behavioral patterns of each customer in order to provide AI-driven personalized recommendations.

- to analyze customer journeys on online platforms to maximize customer experience(CX).

Discovering overtime employees’ repetitive patterns

Employee’s task process told us that : overtime branch show noticeable patterns of repetition and rework.

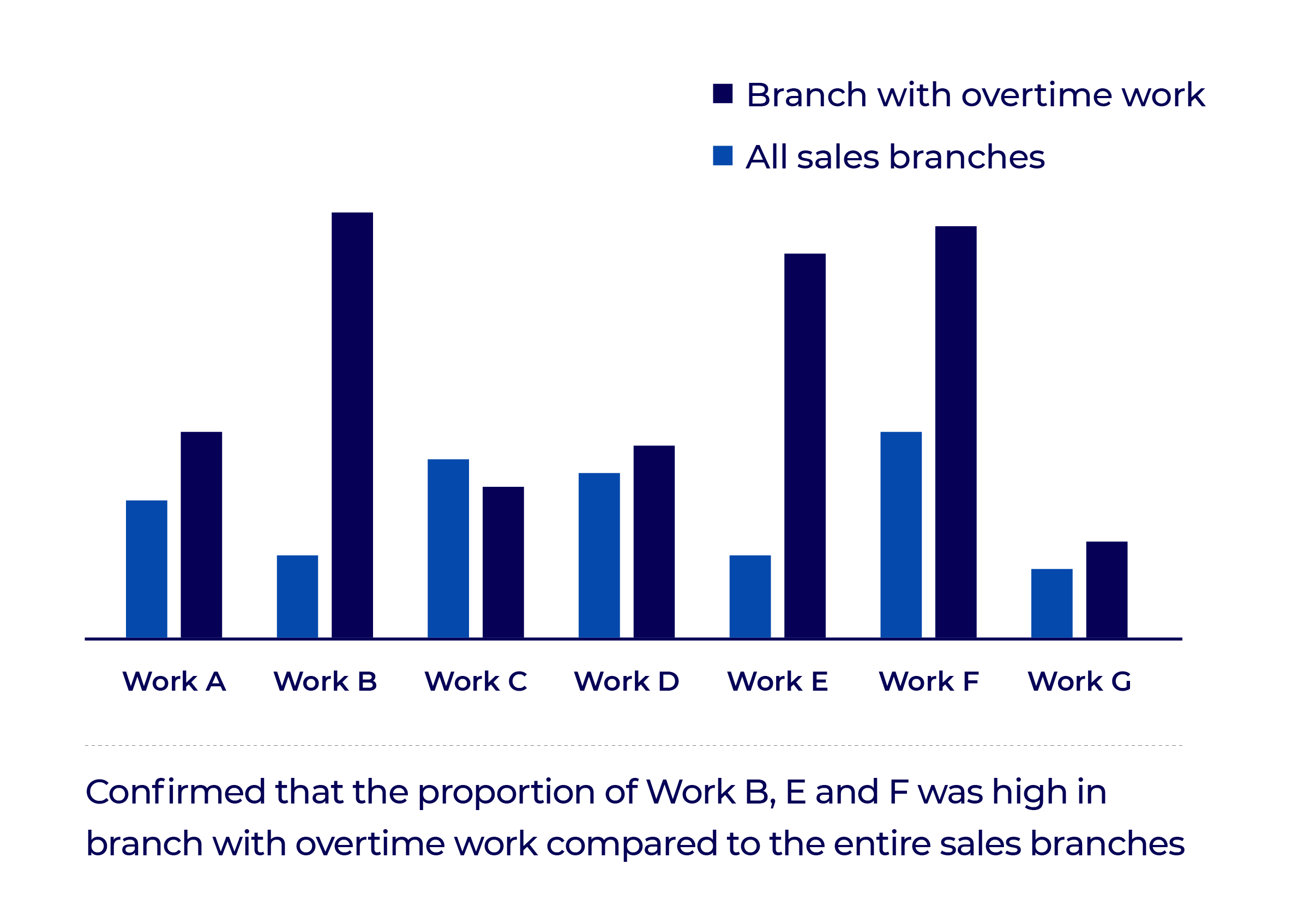

Task usage by Branch types

Task Process of an Employee

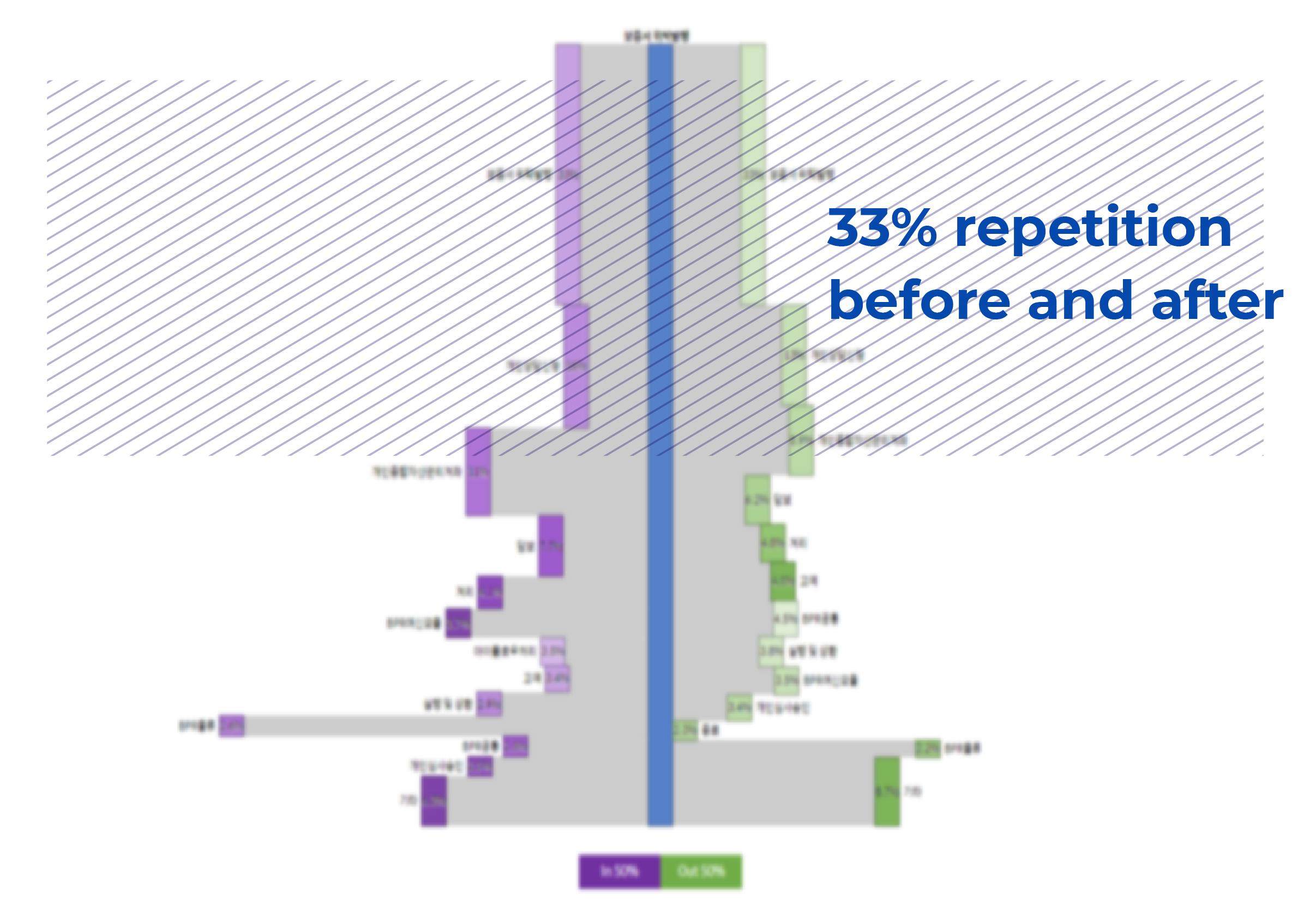

- 33% of work that takes up a high proportion in the branches with overtime work was repetitive work

- The work concerned took a long time compared to other work

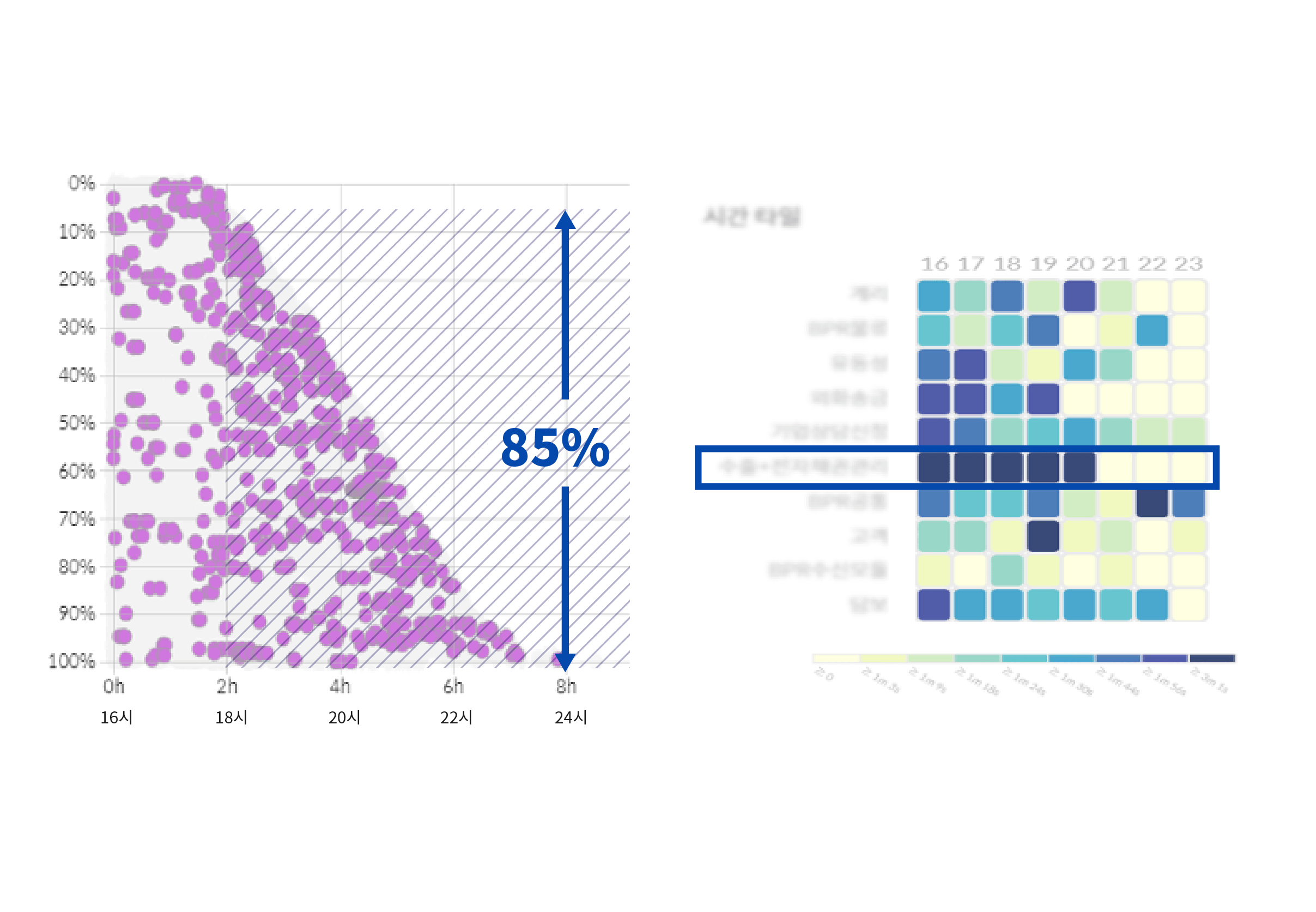

- Confirmed the tendency of which the occurrence frequency gradually increased until leaving the office

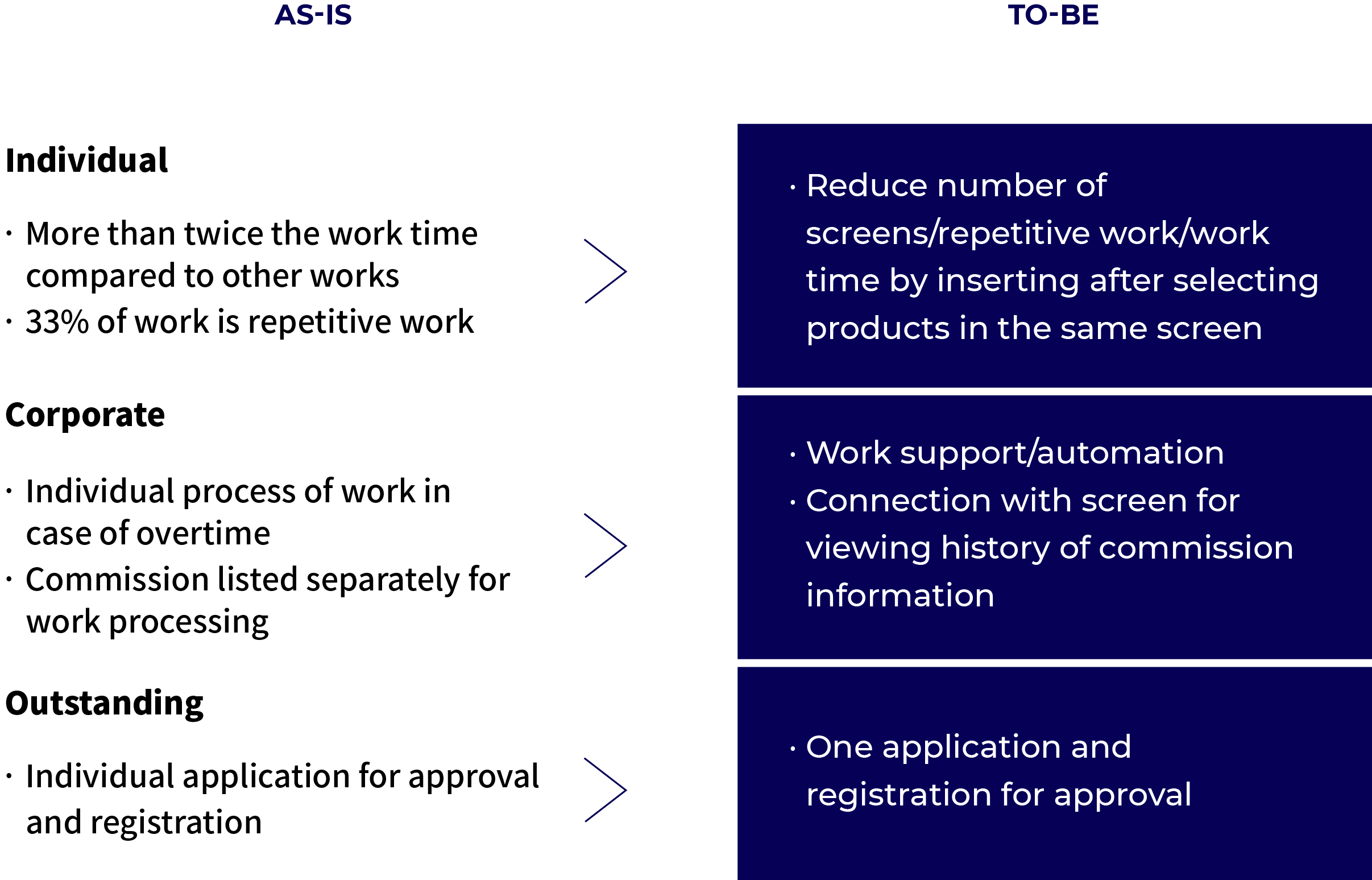

Process before and after work

Work proportion by time

Innovating employees’ task process – intelligently.

The bank changed the task design to take into account the employee’s task sequence, placing related tasks within a single screen, and modified the system’s processes to shorten the employee’s task process, reduce repetitive tasks, and reduce overall lead time.

Managing churn by sticking to process-based signals

Finding key behavioral factors of re-deposit accounts through Process Mining

We found that the number of termination notifications varies by customer, and that retention rates are significantly different depending on the number of notifications received.

- Redeposit rate is 13%p higher for customers who received a notification before termination

- Redeposit rates were 19.8%p higher for customers who were notified twice

- 9.2%p higher for those who were notified by phone in person

→ It was confirmed that notification on early repayment was effective in increasing re-deposit and that the maintenance rate could differ depending on the frequency and contact method

Turn ‘churn concerns’ into ‘loyal users’

Set the Golden Rule for customer re-deposits

By establishing a process-based ‘Golden Rule’, the bank has successfully fostered customer loyalty.

Analysis effect

Improvement of customer experience and work convenience of employees in sales branch and departments in head office through analysis of customer’s behavior pattern and employee’s work process

With ProDiscovery, banking experience transformations have never been clearer.

Have an inquiry?

Get in touch with us.